7162676025: Financial Independence – Steps to Take Now

Achieving financial independence is a multifaceted endeavor that requires careful planning and execution. Individuals must first assess their current financial landscape, including assets and liabilities. A structured budget is essential for tracking expenses and aligning spending with financial goals. Moreover, strategic investments and passive income generation play critical roles in building wealth. Understanding these foundational steps is crucial for anyone seeking long-term financial freedom. What specific strategies can be employed to enhance this journey?

Assess Your Current Financial Situation

Assessing one’s current financial situation is a critical first step toward achieving financial independence.

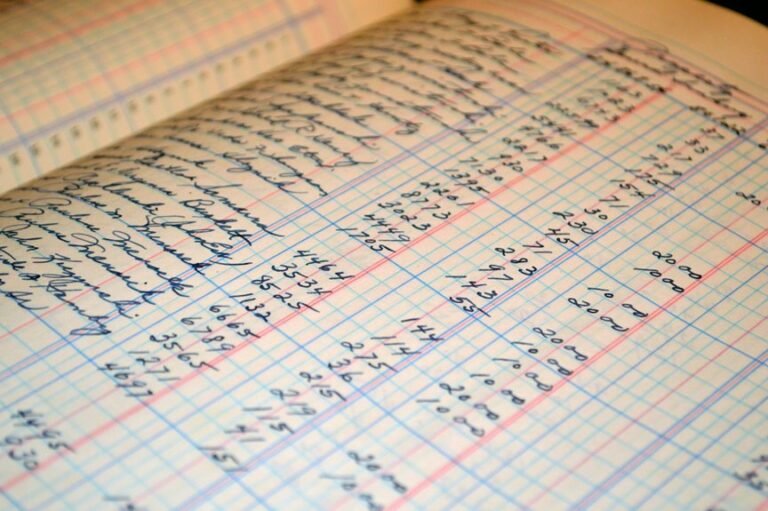

This process involves a thorough examination of current assets and a meticulous debt evaluation. By identifying strengths and weaknesses in financial standing, individuals can develop strategies to eliminate liabilities and enhance savings.

Understanding these key components lays the groundwork for a sustainable path to financial freedom and security.

Create a Budget and Stick to It

With a clear understanding of their financial situation, individuals can move forward to create a budget that aligns with their financial goals.

Employing effective budgeting techniques and consistent expenses tracking ensures that every dollar is accounted for, promoting financial discipline.

Invest in Your Future

Investing in one’s future is a crucial step toward achieving long-term financial independence. Individuals should prioritize contributions to retirement accounts, as these provide tax advantages and compound growth over time.

Additionally, generating passive income through investments in real estate or dividend-paying stocks can further secure financial freedom. By strategically investing now, individuals can cultivate a robust financial foundation for years to come.

Conclusion

In the pursuit of financial independence, taking proactive steps today can yield significant rewards tomorrow. By assessing one’s financial landscape, crafting a disciplined budget, and investing wisely, individuals can transform their economic reality. As the seeds of financial wisdom are sown, they flourish into a garden of prosperity and security. Ultimately, the journey to financial independence is not merely a destination but a continuous process of growth, requiring diligence and strategic foresight to reap its full benefits.