5158759601: Wealth-Building Strategies for 2025

As the landscape of wealth-building evolves towards 2025, individuals must adapt their strategies to remain competitive. The integration of technological advancements, such as AI-driven trading systems, presents new opportunities for market engagement. Simultaneously, diversifying income streams and embracing sustainable investing are essential for long-term financial stability. Understanding the implications of these trends will be crucial for those seeking to navigate the complexities of the economic environment ahead. What specific strategies will emerge as the most effective?

Embracing Technological Advancements for Investment Opportunities

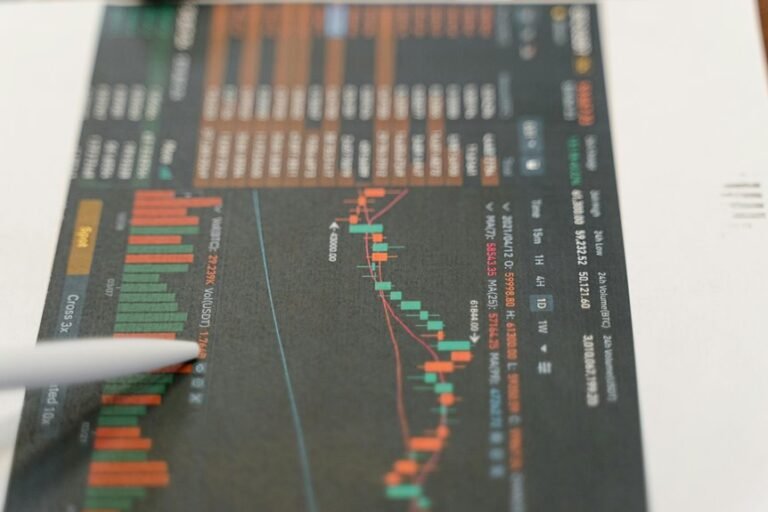

As the financial landscape evolves, investors must recognize that embracing technological advancements can significantly enhance their wealth-building strategies.

AI trading systems analyze vast data sets, predicting market trends with precision, while crypto investments offer new avenues for diversification.

Diversifying Income Streams in a Changing Economic Landscape

While many investors traditionally relied on a single source of income, the evolving economic landscape necessitates a shift towards diversifying income streams.

Embracing passive income opportunities, such as real estate or investments in dividend-yielding stocks, alongside participation in the gig economy, empowers individuals to build financial resilience.

This strategic diversification not only mitigates risk but also enhances freedom and adaptability in uncertain times.

Sustainable and Ethical Investing: A Path to Future Wealth

How can investors align their financial goals with their values?

Sustainable and ethical investing offers a promising avenue through impact investing and green bonds.

These strategies not only generate financial returns but also foster societal and environmental benefits.

Conclusion

As the financial landscape evolves, embracing innovative strategies becomes crucial for wealth-building in 2025. Notably, a study by McKinsey & Company found that companies prioritizing sustainability can achieve up to 60% higher profitability than their less sustainable counterparts. This underscores the importance of integrating technology and ethical investments into diversified portfolios. By adapting to emerging trends and focusing on sustainable practices, individuals can not only enhance their financial stability but also contribute to a more equitable economy.